Creating a comprehensive questionnaire is really important for anyone looking to glean insights from a target audience, whether in research or marketing. A well-structured questionnaire helps ensure that the data collected is accurate and useful for making decisions. It’s key to understand different types of questions such as closed-ended and open-ended ones, as each serves its own purpose. Best practices in question design, like avoiding ambiguous language and double-barreled questions, can significantly improve the quality of responses. Furthermore, thoughtful distribution methods combined with effective data analysis techniques will lead to richer insights. A well-crafted questionnaire is invaluable for gathering meaningful information.

Understanding Questionnaires and Their Purpose

A questionnaire is a tool used to collect information through a series of questions. It serves various purposes across different fields, including market research, education, healthcare, and social sciences. The main aim is to gather data that reflects the thoughts, behaviors, and characteristics of a target group. For example, a business might use a questionnaire to understand customer satisfaction, while a researcher could use it to gather opinions on a social issue.

There are different types of questionnaires that cater to specific needs. Structured questionnaires use closed-ended questions with predefined options, making the data easy to analyze. Semi-structured questionnaires mix closed and open-ended questions, allowing for both quantitative and qualitative insights. Unstructured questionnaires rely mainly on open-ended questions, giving respondents the freedom to express their views in detail. Each type has its own strengths, and choosing the right one depends on the purpose of your research and the type of data you wish to collect.

Types of Questionnaires Explained

Questionnaires can be categorized into three main types based on their structure: structured, semi-structured, and unstructured.

Structured questionnaires consist of closed-ended questions that offer specific response options. These are ideal for quantitative research as they allow for easy data analysis. For example, a structured questionnaire might ask, “How often do you use our product?” with response options like “Daily,” “Weekly,” or “Monthly.”

Semi-structured questionnaires blend closed-ended and open-ended questions. This format allows researchers to collect both quantitative and qualitative data. An example could include a question like, “What features do you like about our product?” followed by a multiple-choice question about frequency of use. This approach provides a broader understanding of user preferences while still allowing for easier analysis of certain aspects.

Unstructured questionnaires primarily include open-ended questions, giving respondents the freedom to express their thoughts in detail. For instance, a question like, “What improvements would you suggest for our service?” allows for deeper insights but can be more challenging to analyze due to the varied responses.

Understanding these types of questionnaires is crucial for selecting the right format based on the research objectives and the type of data you wish to gather.

Designing Effective Questions for Your Questionnaire

Credits: customerthermometer.com

Credits: customerthermometer.com

Effective questions are the cornerstone of any successful questionnaire. To begin with, it’s important to distinguish between closed-ended and open-ended questions. Closed-ended questions, such as multiple choice or Likert scale, provide respondents with specific options to select from, making it easier to quantify and analyze the data. For instance, a question like “How satisfied are you with our service?” can have options ranging from “Very Satisfied” to “Very Dissatisfied.” On the other hand, open-ended questions allow respondents to express their thoughts freely, providing richer qualitative data. An example could be, “What do you think could be improved in our service?” This can yield insights that structured questions might miss.

When designing questions, it’s crucial to ensure each one aligns with your research goals. Avoid irrelevant questions that do not serve a purpose. Use clear and neutral language to prevent misunderstandings. For example, instead of asking, “How would you describe our five-star service?” consider rephrasing it to, “How would you rate your experience with our service?” This way, you maintain objectivity.

It’s also important to avoid double-barreled questions, which tackle multiple issues at once, as they can confuse respondents. For example, asking, “How satisfied are you with our product and customer service?” should be split into two separate questions for clarity.

When using rating scales, ensure they are balanced. If you provide a scale from 1 to 5, make sure it includes equal positive and negative options. Additionally, giving respondents the choice to opt-out of answering certain questions, such as by including a ‘Prefer not to answer’ option, can lead to more honest responses.

Lastly, piloting your questionnaire with a small group can help identify confusing questions and areas for improvement. This testing phase is invaluable in refining your questions to ensure clarity and effectiveness.

Best Practices in Question Design

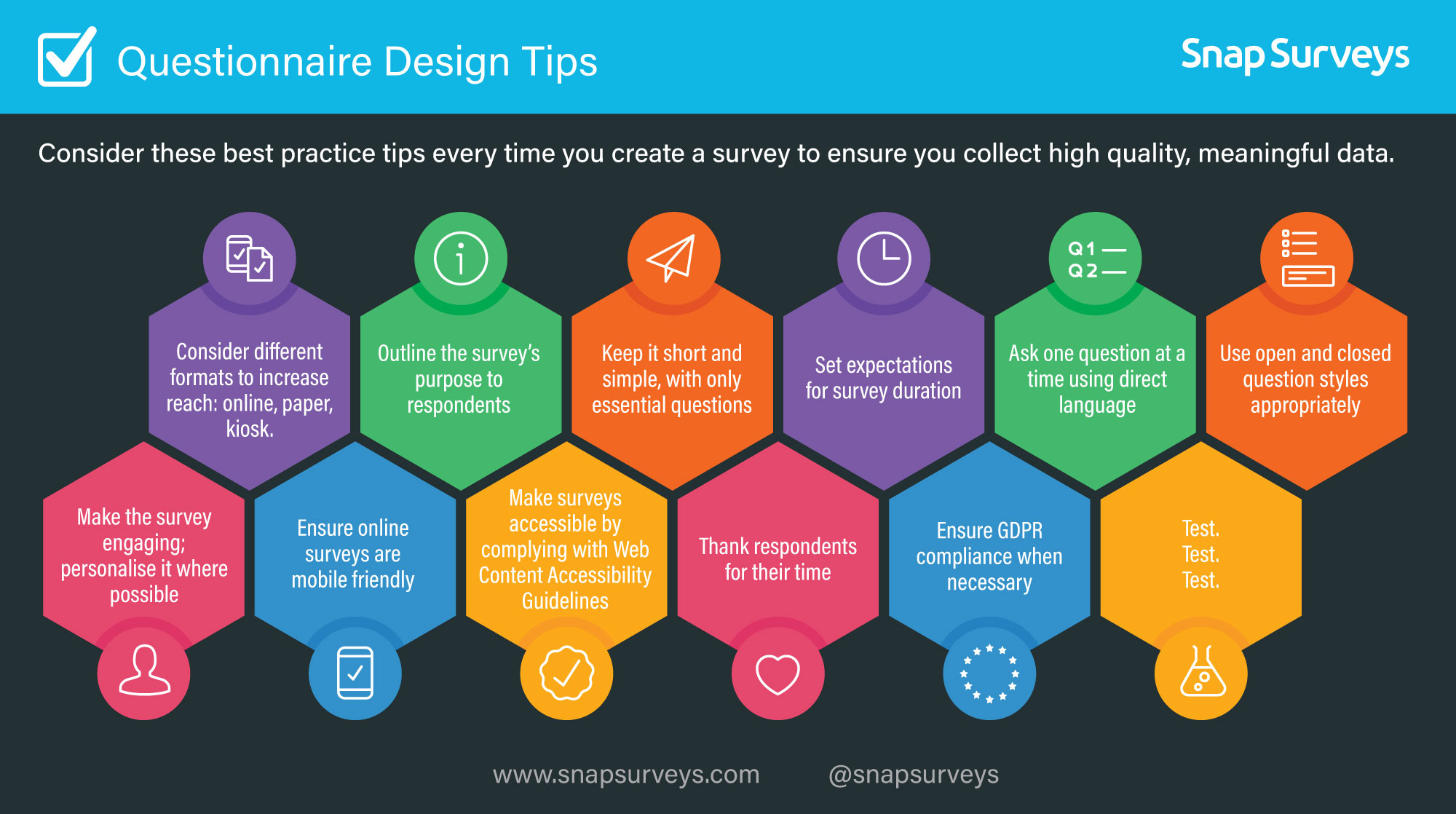

Credits: snapsurveys.com

Credits: snapsurveys.com

When designing questions for your questionnaire, clarity is key. Use straightforward language that all respondents can easily understand. For example, instead of asking, ‘How do you perceive our service quality?’, you might ask, ‘How would you rate our service?’. This helps to minimize confusion and ensures that the answers you receive are relevant and accurate.

It’s also important to focus your questions. Each question should serve a clear purpose aligned with your research objectives. Avoid including unrelated demographic questions unless they are necessary for your analysis.

When utilizing closed-ended questions, ensure that the response options are exhaustive and mutually exclusive. For instance, if you’re asking about age ranges, make sure options like ’18-24′, ’25-34′, etc., don’t overlap. This allows you to gather precise data without ambiguity.

Another important practice is to avoid double-barreled questions, which ask about two different issues at once, such as ‘How satisfied are you with our customer service and product quality?’. Instead, break this into two separate questions to get clearer insights.

Using balanced scales in questions can also prevent bias. For example, when using a Likert scale, ensure there is an equal number of positive and negative response options. If you ask respondents to rate their satisfaction from ‘very dissatisfied’ to ‘very satisfied’, ensure it is symmetrical to avoid skewing results.

Finally, consider piloting your questionnaire with a small group before full distribution. This can help identify any confusing questions and allow you to make adjustments to enhance clarity and effectiveness.

- Ensure questions are clear and concise

- Avoid leading or biased questions

- Use a mix of open-ended and closed-ended questions

- Keep the language simple and accessible

- Order questions logically to maintain flow

- Test questions on a sample group before distribution

- Provide instructions for complex questions

Distribution Methods for Effective Surveys

Credits: pollfish.com

Credits: pollfish.com

Selecting the right distribution method is crucial for maximizing response rates and obtaining quality data from your questionnaire. Online surveys are one of the most popular methods due to their efficiency and reach. Platforms like SurveyMonkey and Google Forms allow you to design your survey and distribute it via email or social media, making it easy for respondents to participate at their convenience. For example, if you’re conducting market research targeting a younger demographic, an online survey shared through social media channels may yield the best results.

Paper surveys can be effective in situations where internet access is limited or among older populations who may prefer traditional methods. Distributing these surveys in places like community centers or during events can help gather responses from those less inclined to use digital tools.

Telephone surveys provide a personal touch, allowing for immediate follow-up questions and clarifications. This method can increase engagement and response rates, particularly in studies that require detailed feedback or when targeting specific populations, such as seniors.

In-person surveys can be the most direct method of data collection. While they may require more time and resources, they can yield rich qualitative insights through face-to-face interactions. For instance, conducting interviews at a local market can help gather opinions on community services while fostering a personal connection with respondents.

Regardless of the method you choose, it’s important to craft a clear introduction and conclusion for your survey. Your introduction should outline the survey’s purpose and emphasize the confidentiality of responses, while the conclusion should thank participants and highlight the value of their contributions.

Analyzing Data from Your Questionnaire

Once you’ve collected responses from your questionnaire, the next critical step is analyzing the data. This process involves examining both quantitative and qualitative data to extract meaningful insights. For closed-ended questions, you can utilize statistical analysis tools like SPSS or Excel. For instance, if you’ve asked respondents to rate their satisfaction on a scale of 1 to 5, you can calculate the average score to determine overall satisfaction. Additionally, you can segment this data by demographics to see how different groups respond.

For open-ended questions, qualitative analysis is essential. Start by coding the responses, where you group similar answers together to identify common themes. For example, if a question asked about reasons for choosing a particular product, you might find themes like ‘price’, ‘quality’, and ‘brand reputation’. These insights can provide depth to your analysis, helping you understand not just what people think, but why they think that way.

Using triangulation can further enhance the reliability of your findings. For example, if your questionnaire results indicate a high customer satisfaction rate, you might compare this with data from customer reviews or follow-up interviews. This approach helps validate your conclusions and provides a more comprehensive understanding of the subject at hand.

Enhancing Reliability with Triangulation

Triangulation is a method used to enhance the reliability and validity of your research findings. It involves using multiple sources, methods, or researchers to cross-verify data, ensuring that the results are not just a product of one approach or perspective. For example, if you’re conducting a survey about customer satisfaction, you might combine survey results with insights from customer interviews and feedback from social media. By comparing these different data sources, you can identify patterns and discrepancies, which strengthens the overall conclusion. This approach not only adds depth to your analysis but also helps to confirm the accuracy of your findings. When results from different methods align, it increases confidence in the data, making your conclusions more robust.

Final Thoughts on Crafting Your Questionnaire

Crafting your questionnaire is an iterative process that demands attention to detail and a clear understanding of your objectives. Always keep your target audience in mind. Consider their perspectives and experiences when designing questions, as this will enhance the quality of the responses you receive. For instance, if you are surveying high school students about their learning preferences, using language that resonates with them will yield more insightful answers.

Additionally, be mindful of the length and complexity of your questionnaire. Long or overly complicated surveys can lead to respondent fatigue, resulting in incomplete or careless answers. Strive for brevity while ensuring that each question serves a purpose. A focused questionnaire not only respects the respondent’s time but also increases the likelihood of completing the survey.

Finally, after collecting your data, take the time to reflect on the entire process. Analyze what worked well and what could be improved for future questionnaires. This reflective practice is essential for honing your skills and ensuring that each subsequent questionnaire you create is even more effective than the last.

Frequently Asked Questions

1. Why is it important to create a detailed questionnaire?

A detailed questionnaire helps gather accurate information, ensuring you understand the needs and opinions of your audience.

2. What elements should I include in my questionnaire?

Include clear questions, multiple choice options, open-ended questions, and instructions to guide respondents.

3. How can I ensure my questionnaire is easy to understand?

Use simple language, avoid jargon, and keep questions concise to make it clear for everyone.

4. What are some tips for organizing my questionnaire?

Start with general questions, then move to specific ones, and group related questions together for a smoother flow.

5. How can I encourage people to fill out my questionnaire?

Make it engaging, keep it short, and explain how their input will be valuable to encourage participation.

TL;DR Creating a comprehensive questionnaire is crucial for gathering reliable insights. It involves understanding types of questionnaires, designing effective questions, following best practices, choosing appropriate distribution methods, and analyzing the collected data. Different question types (closed-ended and open-ended) serve distinct purposes. Use balanced scales, clear language, and pilot tests to improve question quality. Data analysis can be quantitative or qualitative, and triangulation enhances reliability. By carefully crafting your questionnaire, you can obtain meaningful insights that drive decision-making.